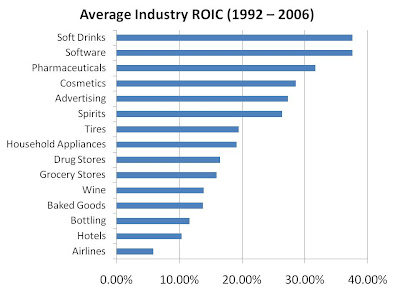

Harvard Professor Michael Porter, using data from Standard and Poor's as well as Compustat, has calculated the profitabilites of various industries over the 1992-2006 period, some of which are shown below:

Clearly, there is high variability in returns on capital by industry. Average industry ROIC in the US was calculated at 14.9% by Porter, demonstrating that some industries are clearly extremely profitable, while others destroy capital.

Does this mean you shouldn't own a company whose industry returns fall below the average ROIC? Absolutely not! Within industries, returns may also be highly variable, in the case where one or two companies have differentiated themselves or are low-cost producers that generate consistent industry-beating returns...but you may still want to stay away from the airline industry!

6 comments:

Hi Saj, do you have the original article/data by Michael Porter? I'm interested in reading it. Thank you.

Hi Enoch,

Unfortunately I only have a hardcopy, from the CFA Level 2 curriculum. Perhaps a search engine might tell you where to purchase a copy; I couldn't find a free version, sorry.

The article is here:

http://hbr.harvardbusiness.org/2008/01/the-five-competitive-forces-that-shape-strategy/ar/1

Here is the chart, securities brokers and dealers at the very top.

http://lh4.ggpht.com/_TcZIHGRFnvY/SdgrZnbNPdI/AAAAAAAAAFA/oi7JTFBq2bM/Harvard%20Chart.jpg

Thank you very much, Anonymous! Looks like security brokerage & dealers have got a good business there! Hmmm... perhaps I should get into that business!

Do you happen to have a PDF you can e-mail to me? My e-mail's in my profile. Thank you!

There can only be a limited number of brokers per 1000 people. New entrants will find it difficult to find new customers. The high RIOC comes from the low level of capital needed.

Post a Comment